Recommendations Of SEC Government-Business Forum On Small Business Capital Formation

In early April, the SEC Office of Small Business Policy published the 2016 Final Report on the SEC Government-Business Forum on Small Business Capital Formation, a forum I had the honor of attending and participating in. As required by the Small Business Investment Incentive Act of 1980, each year the SEC holds a forum focused on small business capital formation. The goal of the forum is to develop recommendations for government and private action to eliminate or reduce impediments to small business capital formation.

The forum is taken seriously by the SEC and its participants, including the NASAA, and leading small business and professional organizations. The forum began with short speeches by each of the SEC commissioners and a panel discussion, following which attendees, including myself, worked in breakout sessions to drill down on specific issues and suggest changes to rules and regulations to help support small business capital formation, as well as the related, secondary trading markets. In particular, the three breakout groups were on exempt securities offerings; smaller reporting companies; and the secondary market for securities of small businesses.

Each breakout group is given the opportunity to make recommendations. The recommendations were refined and voted upon by the forum participants in the few months following the forum and have now been released by the SEC in a report containing all 15 final recommendations. In the process, the participants ranked the recommendations by whether it is likely the SEC will give high, medium, low or no priority to each recommendation.

Recommendations often gain traction. For example, the forum first recommended reducing the Rule 144 holding period for Exchange Act reporting companies to six months, a rule which was passed in 2008. Last year the forum recommended increasing the financial thresholds for the smaller reporting company definition, and the SEC did indeed propose a change following that recommendation. See my blog HERE for more information on the proposed change. Also last year the forum recommended changes to Rule 147 and 504, which recommendations were considered in the SEC’s rule changes that followed. See my blog HERE for information on the new Rule 147A and Rule 147 and 504 changes.

Forum Recommendations

The following is a list of the recommendations listed in order or priority. The priority was determined by a poll of all participants and is intended to provide guidance to the SEC as to the importance and urgency assigned to each recommendation. I have included my comments and commentary with the recommendations.

- As recommended by the SEC Advisory Committee on Small and Emerging Companies, the SEC should (a) maintain the monetary thresholds for accredited investors; and (b) expand the categories of qualification for accredited investor status based on various types of sophistication, such as education, experience or training, including, but not limited to, persons with FINRA licenses, CPA or CFA designations, or management positions with issuers. My blog on the Advisory Committee on Small and Emerging Companies’ recommendations can be read HERE. Also, to read on the SEC’s report on the accredited investor definition, see HERE.

- The definition of smaller reporting company and non-accelerated filer should be revised to include an issuer with a public float of less than $250 million or with annual revenues of less than $100 million, excluding large accelerated filers; and to extend the period of exemption from Sarbanes 404(b) for an additional five years for pre- or low-revenue companies after they cease to be emerging-growth companies. See my blog HERE for more information on the current proposed change to the definition of smaller reporting company and HERE related to the distinctions between a smaller reporting company and an emerging-growth company.

- Lead a joint effort with NASAA and FINRA to implement a private placement broker category including developing a workable timeline and plan to regulate and allow for “finders” and limited intermediary registration, regulation and exemptions. I think this topic is vitally important. The issue of finders has been at the forefront of small business capital formation during the 20+ years I have been practicing securities law. The topic is often explored by regulators; see, for example, the SEC Advisory Committee on Small and Emerging Companies recommendations HERE and a more comprehensive review of the topic HERE which includes a summary of the American Bar Association’s recommendations.

Despite all these efforts, it has been very hard to gain any traction in this area. Part of the reason is that it would take a joint effort by FINRA, the NASAA and both the Divisions of Corporation Finance and Trading and Markets within the SEC. This area needs attention. The fact is that thousands of people act as unlicensed finders—an activity that, although it remains illegal, is commonplace in the industry. In other words, by failing to address and regulate finders in a workable and meaningful fashion, the SEC and regulators perpetuate an unregulated fringe industry that attracts bad actors equally with the good and results in improper activity such as misrepresentations in the fundraising process equally with the honest efforts. However, practitioners, including myself, remain committed to affecting changes, including by providing regulators with reasoned recommendations.

- The SEC should adopt rules that pre-empt state registration for all primary and secondary trading of securities qualified under Regulation A/Tier 2, and all other securities registered with the SEC. I have been a vocal proponent of state blue sky pre-emption, including related to the secondary trading of securities. Currently, such secondary trading is usually achieved through the Manual’s Exemption, which is not recognized by all states. There is a lack of uniformity in the secondary trading market that continues to negatively impact small business issuers. For more on this topic, see my two-part blog HERE and HERE.

- Regulation A should be amended to: (i) pre-empt state blue sky regulation for all secondary sales of Tier 2 securities (included in the 4th recommendation above); (ii) allow companies registered under the Exchange Act, including at least business development companies, emerging-growth companies and smaller reporting companies, to utilize Regulation A (see my blog on this topic, including a discussion of a proposed rule change submitted by OTC Markets, HERE ); and (iii) provide a clearer definition of what constitutes “testing-the-waters materials” and permissible media activities.

- Simplify disclosure requirements and costs for smaller reporting companies and emerging-growth companies with a principles-based approach to Regulation S-K, eliminating information that is not material, reducing or eliminating non-securities-related disclosures with a political or social purpose (such as pay ratio, conflict minerals, etc.), making XBRL compliance optional and harmonizing rules for emerging-growth companies with smaller reporting companies. For more on the ongoing efforts to revise Regulation S-K, including in manners addressed in this recommendation, see HERE and for more information on the differences between emerging-growth companies and smaller reporting companies, see HERE.

- Mandate comparable disclosure by short sellers or market makers holding short positions that apply to long investors, such as through the use of a short selling report on Schedule 13D.

- The SEC should provide scaled public disclosure requirements, including the use of non-GAAP accounting standards that would constitute adequate current information for entities whose securities will be traded on secondary markets. This recommendation came from the secondary market for securities of small businesses breakout group. I was part of the smaller reporting companies breakout group, so I did not hear the specific discussion on this recommendation. However, I do note that Rule 144 does provide for a definition of adequate current public information for companies that are not subject to the Exchange Act reporting requirements. In particular, Rule 144 provides that adequate current public information would include the information required by SEC Rule 15c2-11 and OTC Markets specifically models its alternative reporting disclosure requirements to satisfy the disclosures required by Rule 15c2-11.

- The eligibility requirements for the use of Form S-3 should be revised to include all reporting companies. For more on the use of Form S-3, see my blog HERE.

- The SEC should clarify the relationship of exempt offerings in which general solicitation is not permitted, such as in Section 4(a)(2) and Rule 506(b) offerings, with Rule 506(c) offerings involving general solicitation in the following ways: (i) the facts and circumstances analysis regarding whether general solicitation is attributable to purchasers in an exempt offering should apply equally to offerings that allow general solicitation as to those that do not (such that even if an offering is labeled 506(c), if in fact no general solicitation is used, it can be treated as a 506(b); and (ii) to clarify that Rule 152 applies to Rule 506(c) so that an issuer using Rule 506(c) may subsequently engage in a registered public offering without adversely affecting the Rule 506(c) exemption. I note that within days of the forum, the SEC did indeed issue guidance on the use of Rule 152 as applies to Rule 506(c) offerings, at least as relates to an lternative trading systemintegration analysis between 506(b) and 506(c) offerings. See my blog HERE.

- The SEC should amend Regulation ATS to allow for the resale of unregistered securities including those traded pursuant to Rule 144 and 144A and issued pursuant to Sections 4(a)(2), 4(a)(6) and 4(a)(7) and Rules 504 and 506.

- The SEC should permit an ATS to file a 15c2-11 with FINRA and review the FINRA process to make sure that there is no undue burden on applicants and issuers. An ATS is an “alternative trading system.” The OTC Markets’ trading platform is an ATS. This recommendation would allow OTC Markets to directly file 15c2-11 applications on behalf of companies. A 15c2-11 application is the application submitted to FINRA to obtain a trading symbol and allow market makers to quote the securities of companies that trade on an ATS, such as the OTC Markets. Today, only market makers seeking to quote the trading in securities can submit the application. Also today, the application process can be difficult and lack clear guidance or timelines for the market makers and companies involved. This process definitely needs attention and this recommendation would be an excellent start.

- Regulation CF should be amended to (i) permit the usage of special-purpose vehicles so that many small investors may be grouped together into one entity which then makes a single investment in a company raising capital under Regulation CF; and (ii) harmonize the Regulation CF advertising rules to avoid traps in situations where an issuer advertises or engages in general solicitations under Regulation A or Rule 506(c) and then converts to or from a Regulation CF offering.

- The SEC should provide greater clarity on when trading activities require ATS registration, and when an entity or technology platform needs to a funding portal, broker-dealer, ATS and/or exchange in order to “be engaged in the business” of secondary trading transactions.

- Reduce the Rule 144 holding period to 3 months for reporting companies. I fully support this recommendation.

The Author

Laura Anthony, Esq.

Founding Partner

Legal & Compliance, LLC

Corporate, Securities and Going Public Attorneys

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

Phone: 800-341-2684 – 561-514-0936

Fax: 561-514-0832

LAnthony@LegalAndCompliance.com

www.LegalAndCompliance.com

www.LawCast.com

Securities attorney Laura Anthony and her experienced legal team provides ongoing corporate counsel to small and mid-size private companies, OTC and exchange traded issuers as well as private companies going public on the NASDAQ, NYSE MKT or over-the-counter market, such as the OTCQB and OTCQX. For nearly two decades Legal & Compliance, LLC has served clients providing fast, personalized, cutting-edge legal service. The firm’s reputation and relationships provide invaluable resources to clients including introductions to investment bankers, broker dealers, institutional investors and other strategic alliances. The firm’s focus includes, but is not limited to, compliance with the Securities Act of 1933 offer sale and registration requirements, including private placement transactions under Regulation D and Regulation S and PIPE Transactions as well as registration statements on Forms S-1, S-8 and S-4; compliance with the reporting requirements of the Securities Exchange Act of 1934, including registration on Form 10, reporting on Forms 10-Q, 10-K and 8-K, and 14C Information and 14A Proxy Statements; Regulation A/A+ offerings; all forms of going public transactions; mergers and acquisitions including both reverse mergers and forward mergers, ; applications to and compliance with the corporate governance requirements of securities exchanges including NASDAQ and NYSE MKT; crowdfunding; corporate; and general contract and business transactions. Moreover, Ms. Anthony and her firm represents both target and acquiring companies in reverse mergers and forward mergers, including the preparation of transaction documents such as merger agreements, share exchange agreements, stock purchase agreements, asset purchase agreements and reorganization agreements. Ms. Anthony’s legal team prepares the necessary documentation and assists in completing the requirements of federal and state securities laws and SROs such as FINRA and DTC for 15c2-11 applications, corporate name changes, reverse and forward splits and changes of domicile. Ms. Anthony is also the author of SecuritiesLawBlog.com, the OTC Market’s top source for industry news, and the producer and host of LawCast.com, the securities law network. In addition to many other major metropolitan areas, the firm currently represents clients in New York, Las Vegas, Los Angeles, Miami, Boca Raton, West Palm Beach, Atlanta, Phoenix, Scottsdale, Charlotte, Cincinnati, Cleveland, Washington, D.C., Denver, Tampa, Detroit and Dallas.

Contact Legal & Compliance LLC. Technical inquiries are always encouraged.

Follow me on Facebook, LinkedIn, YouTube, Google+, Pinterest and Twitter.

Legal & Compliance, LLC makes this general information available for educational purposes only. The information is general in nature and does not constitute legal advice. Furthermore, the use of this information, and the sending or receipt of this information, does not create or constitute an attorney-client relationship between us. Therefore, your communication with us via this information in any form will not be considered as privileged or confidential.

This information is not intended to be advertising, and Legal & Compliance, LLC does not desire to represent anyone desiring representation based upon viewing this information in a jurisdiction where this information fails to comply with all laws and ethical rules of that jurisdiction. This information may only be reproduced in its entirety (without modification) for the individual reader’s personal and/or educational use and must include this notice.

© Legal & Compliance, LLC 2017

« Road Shows FINRA Proposes New Registration And Examination Rules »

Road Shows

Introduction; Definitions

We often hear the words “road show” associated with a securities offering. A road show is simply a series of presentations made by company management to key members of buy-side market participants such as broker-dealers that may participate in the syndication of an offering, and institutional investor groups and money managers that may invest into an offering. A road show is designed to provide these market participants with more information about the issuer and the offering and a chance to meet and assess management, including their presentation skills and competence in a Q&A setting. Investors often place a high level of importance on road show meetings and as such, a well-run road show can make the difference as to the level of success of an offering.

A road show usually involves an intensive period of multiple meetings and presentations in a number of different cities over a one-to-two-week period. Although road shows are generally live, they can be by teleconference, or electronic using prepared written presentation materials. In today’s Internet world, road shows are often recorded from a live presentation and made available publicly for a period of time. The meetings and presentations can vary in length and depth depending on the size and importance of the particular audience. During the road show, the underwriters are building a book of interest which will help determine the pricing for the offering.

A company can also conduct a “non-deal road show” for the purpose of driving interest in the company and its stock, where no particular offering is planned.

Unless it is a non-deal road show, the road show involves an offer of securities. “Offers” of securities are very broadly defined. Section 2(a)(3) of the Securities Act defines “offer to sell,” “offer for sale,” or “offer” to include “every attempt or offer to dispose of, or solicitation of an offer to buy, a security or interest in a security, for value.”

The timing and manner of all offers of securities are regulated, and especially so in registered offerings. All issuers that have filed a registration statement are permitted to make oral offers of their securities, but only certain types of written offers are allowed. Written offers must comply with Section 10 of the Securities Act, including a requirement that a prospectus meeting the information requirements in Section 10(a) be delivered at the time of or prior to the offer. In addition, certain eligible issuers may provide supplemental written information and graphic communications not otherwise included in the prospectus filed with the SEC (i.e., a free writing prospectus) as part of an offer of securities. All of these oral and written communication rules are implicated in the road show process and must be considered when planning and completing the road show.

A road show is generally timed to be completed in the last few weeks before a registration statement goes effective or a Regulation A offering circular becomes qualified. In a registered offering, Section 5(c) prohibits offers prior to the filing of the registration statement and as such, the road show would never commence pre-filing. Regulation A is not a registered offering for purposes of Section 5(c), but for practical purposes, a Regulation A road show also commences right before SEC qualification. Rule 163 provides an exception to the pre-filing offer rules only available to well-known seasoned issuers (very big companies), which is not discussed in this blog.

For a private offering, the road show occurs once the offering documents are completed. An Emerging Growth Company (EGC) that has filed its registration statement on a confidential basis must make the initial filing and all confidentially submitted amendments public a minimum of 15 days prior to starting the road show.

A road show is subject to the test-the-waters and pre-effective communication rules. For a review of testing the waters in a registered offering, see HERE and for Regulation A offerings, see HERE.

A road show is specifically regulated under Rule 433 of the Securities Act and the free writing prospectus rules. Securities Act Rule 433(h)(4) defines a road show as an offer, other than a statutory prospectus, that “contains a presentation regarding an offering by one or more of the members of the issuer’s management ….. and includes discussion of one or more of the issuer, such management, and the securities being offered.”

The SEC definition of road show includes the language “other than a statutory prospectus.” The statutory prospectus is one that meets the requirements of Section 10(a) of the Securities Act and is generally the filed final prospectus that contains the disclosures outlined in the particular offering form being used (for example, Form S-1 or 1-A) and including disclosures delineated in Regulations S-K and S-X.

In general, if the information being presented in a road show is nothing more than what is already included in the prospectus filed with the SEC, there are no particular SEC filing requirements. On the other hand, if the information is written and goes beyond the statutory prospectus, it may be considered a “free writing prospectus” and be subject to specific eligibility requirements for use, form and content and SEC filing requirements all as set forth in Rule 433 and discussed herein.

Rule 405 of the Securities Act defines a free writing prospectus (“FWP”) as “any written communication as defined in this section that constitutes an offer to sell or a solicitation of an offer to buy the securities relating to a registered offering that is used after the registration statement in respect of the offering is filed… and is made by means other than (i) a prospectus satisfying the requirements of Section 10(a) of the Act…; (2) a written communication used in reliance on Rule 167 and Rule 426 (note that both rules relate to offerings by asset backed issuers); or (3) a written communication that constitutes an offer to sell or solicitation of an offer to buy such securities that falls within the exception from the definition of prospectus in clause (a) of Section 2(a)(10) of the Act.” Section 2(a)(10)(a) in turn exempts written communications that are provided after a registration statement goes effective with the SEC as long as the effective registration statement is provided to the recipient prior to or at the same time.

Types of Road Shows; Oral/Live vs. Written; Free Writing Prospectus (FWP) Requirements

The rules distinguish between a “live” vs. a “written” road show communication, with one being an “oral offer” and more freely allowed and the other being a “written offer” and more strictly regulated. In addition, the rules differentiate requirements based on whether a road show is for a registered or private offering and, if a registered offering, whether such offering is an initial public offering (IPO) involving common or convertible equity.

Where a road show communication is purely oral, it is not an FWP and thus there are no specific SEC filing requirements (though see the discussion on Regulation FD below). Where an oral communication implicates Regulation FD, a Form 8-K would need to be filed regardless of whether the communication is during a road show or in any other forum.

Although road shows are generally live and specifically designed to constitute oral offers, they can also be electronic using prepared written presentation materials. Both live and electronic road shows may be available for replay electronically over the Internet.

Live road shows include: (i) a live, in-person presentation to a live, in-person audience; (ii) a live, real-time presentation to a live audience or simultaneous multiple audiences transmitted electronically; (iii) a concurrent live presentation and real-time electronic transmittal of such presentation; (iv) a webcast or video conference that originates live and is transmitted in real time; (v) a live telephone conversation, even if it is recorded; and (vi) the slide deck or other presentation materials used during the road show unless investors are allowed to print or take copies of the information.

The explanatory note to Rule 433(d)(8) states: “A communication that is provided or transmitted simultaneously with a road show and is provided or transmitted in a manner designed to make the communication available only as part of the road show and not separately is deemed to be part of the road show. Therefore, if the road show is not a written communication, such a simultaneous communication (even if it would otherwise be a graphic communication or other written communication) is also deemed not to be written.”

Accordingly, road show slides and video clips are not considered to be written offers as long as copies are not left behind. Even handouts are not written offers so long as they are collected at the end of the presentation. If they are left behind, however, they become a free writing prospectus (FWP) and are subject to Securities Act Rules 164 and 433, including a requirement that the materials be filed with the SEC.

A video recording of the road show meeting will not need to be filed as an FWP so long as it is available on the Internet to everyone and covers the same ground as the live road show. Such video road shows are considered a “bona fide electronic road show.” Rule 433(h)(5) defines a “bona fide electronic road show” as a road show “that is a written communication transmitted by graphic means that contains a presentation by one or more officers of an issuer or other persons in an issuer’s management….” It is permissible to have multiple versions of a bona fide electronic road show as long as all versions are available to an unrestricted audience. For example, different members of management may record different presentations and, although access must be unrestricted, management may record versions that are more retail investor facing or institutional investor facing.

On the other hand, a FWP would include any written communication that could constitute an offer to sell or a solicitation of an offer to buy securities subject to a registration statement that is used after the filing of a registration statement and before its effectiveness. A FWP is a supplemental writing that is not part of the filed registration statement. If the writing is simply a repetition of information contained in the filed registration statement, it may be used without regard to the separate FWP rule.

Rule 405 of the Securities Act defines a written communication as any communication that is “written, printed, a radio or television broadcast or a graphic communication.” A graphic communication includes “all forms of electronic media, including but not limited to, audiotapes, videotapes, facsimiles, CD Rom, electronic mail, internet websites, substantially similar messages widely distributed (rather than individually distributed) on telephone answering or voice mail systems, computers, computer networks and other forms of computer data compilation.” Basically, for purposes of rules related to FWP’s, all communications that can be reduced to writing are considered a written communication. Accordingly, radio and TV interviews, other than those published by unaffiliated and uncompensated media, would be considered a FWP and subject to the SEC use and filing rules.

Electronic road shows that do not originate live and in real time are considered written communications and FWP’s. Once it is determined that a road show includes a FWP, unless an exemption applies, an SEC filing is required. As mentioned, bona fide electronic road shows, although technically a FWP, are not required to be filed with the SEC. In addition, Rule 433 only requires the filing of a FWP for an IPO of common or convertible equity.

A non-exempted FWP must be filed with the SEC, using Form 8-K, no later than the date of first use. An after-hours filing will satisfy this requirement as long as it is on the same calendar day. Moreover, all FWP’s must be filed with the SEC, whether distributed by the registrant or another offering participant and whether such distribution was intentional or unintentional.

The use of a FWP has specific eligibility requirements. A FWP may not be used by any issuer that is “ineligible” for such use. The following entities are ineligible to use a free writing prospectus: (i) companies that are or were in the past three years a blank-check company; (ii) companies that are or were in the past three years a shell company; (iii) penny-stock issuers; (iv) companies that conducted a penny-stock offering within the past three years; (v) business development companies; (vi) companies that are delinquent in their Exchange Act reporting requirements; (vii) limited partnerships that are engaged in an offering that is not a firm commitment offering; and (viii) companies that have filed or have been forced into bankruptcy in the last three years.

Small- and micro-cap issuers will rarely be eligible to use a free writing prospectus. Accordingly, small and micro-cap companies generally are limited to live road shows involving oral offers not constituting a FWP.

Moreover, underwriters generally require specific representations and warranties and indemnification related to FWP’s regardless of whether they are required to be filed with the SEC.

Content

The road show presentation usually covers key aspects of the offering itself, including the reasons for the offering and use of proceeds. In addition, management will also cover important aspects of their business and growth plans, industry trends, competition and the market for their products or services. An important aspect of the road show is the question-and-answer period or Q&A, though obviously this is only included in live interactive road shows. It is common for materials to include drilled-down information that is provided on a higher level in the prospectus as well as theory and thoughts behind business plans and management goals.

The preparation of the road show content is usually a collaborative effort between the company, underwriters and legal counsel. Although the road show begins much later in the process, since its content is derived from the registration statement, ideally the planning begins at the same time as the registration statement drafting. Also, slides, PowerPoint presentations and other presentation materials should be carefully prepared to get the most out of their effectiveness.

The lawyer generally reviews all materials for compliance with the rules related to offering communications as well as potential liability for the representations themselves. Part of the compliance review is ensuring that no statements conflict with or provide a material change to the information in the filed offering prospectus; that could be deemed materially misleading by content or omission; and compliance with Regulation FD if applicable.

Also from a technical legal perspective, all road show materials should contain a disclaimer for forward-looking statements, and that disclaimer should be read in live or prerecorded road show presentations. Where the road show content includes a FWP, it is required to contain a legend indicating that a prospectus has been filed, where it can be read (a hyperlink can satisfy this requirement), and advising prospectus investors to read the prospectus.

Under Rule 433(b)(2), the FWP for a non-reporting or unseasoned company must be accompanied with or preceded by the prospectus filed with the SEC. The delivery requirement can be satisfied by providing a hyperlink to the filed prospectus on the EDGAR database.

Road show materials, even those that are also a FWP, generally are not subject to liability under Section 11 of the Securities Act. Section 11 provides a private cause of action in favor of purchasers of securities, against those involved in filing a false or misleading public offering registration statement. Road-show materials, including FWPs, are not a part of the registration statement, but rather are supplemental materials. Section 12 liability, however, does apply to road-show materials. Section 12 provides liability against the seller of securities for material misstatements or omissions in connection with that sale, whether oral or in writing.

Follow-on Offerings and Regulation FD

Regulation FD requires that companies subject to the SEC reporting requirements take steps to ensure that material information is disclosed to the general public in a fair and fully accessible manner such that the public as a whole has simultaneous access to the information. Consequently, Regulation FD would be implicated in connection with communications in a road show for a follow-on offering by a company already subject to the Exchange Act reporting requirements. Regulation FD excludes communications (i) to a person who owes the issuer a duty of trust or confidence, such as legal counsel and financial advisors; (ii) communications to any person who expressly agrees to maintain the information in confidence; and (iii) communications in connection with certain offerings of securities registered under the Securities Act of 1933 (this exemption does not include registered shelf offerings).

Where a road show is being conducted by a company subject to the Exchange Act reporting requirements, counsel should ensure that that the presentation either does not include material non-public information or that the information is simultaneously disclosed to the public in a Form 8-K. As a backstop where Regulation FD applies, the company should also consider having all road-show attendees sign a confidentiality agreement.

The Author

Laura Anthony, Esq.

Founding Partner

Legal & Compliance, LLC

Corporate, Securities and Going Public Attorneys

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

Phone: 800-341-2684 – 561-514-0936

Fax: 561-514-0832

LAnthony@LegalAndCompliance.com

www.LegalAndCompliance.com

www.LawCast.com

Securities attorney Laura Anthony and her experienced legal team provides ongoing corporate counsel to small and mid-size private companies, OTC and exchange traded issuers as well as private companies going public on the NASDAQ, NYSE MKT or over-the-counter market, such as the OTCQB and OTCQX. For nearly two decades Legal & Compliance, LLC has served clients providing fast, personalized, cutting-edge legal service. The firm’s reputation and relationships provide invaluable resources to clients including introductions to investment bankers, broker dealers, institutional investors and other strategic alliances. The firm’s focus includes, but is not limited to, compliance with the Securities Act of 1933 offer sale and registration requirements, including private placement transactions under Regulation D and Regulation S and PIPE Transactions as well as registration statements on Forms S-1, S-8 and S-4; compliance with the reporting requirements of the Securities Exchange Act of 1934, including registration on Form 10, reporting on Forms 10-Q, 10-K and 8-K, and 14C Information and 14A Proxy Statements; Regulation A/A+ offerings; all forms of going public transactions; mergers and acquisitions including both reverse mergers and forward mergers, ; applications to and compliance with the corporate governance requirements of securities exchanges including NASDAQ and NYSE MKT; crowdfunding; corporate; and general contract and business transactions. Moreover, Ms. Anthony and her firm represents both target and acquiring companies in reverse mergers and forward mergers, including the preparation of transaction documents such as merger agreements, share exchange agreements, stock purchase agreements, asset purchase agreements and reorganization agreements. Ms. Anthony’s legal team prepares the necessary documentation and assists in completing the requirements of federal and state securities laws and SROs such as FINRA and DTC for 15c2-11 applications, corporate name changes, reverse and forward splits and changes of domicile. Ms. Anthony is also the author of SecuritiesLawBlog.com, the OTC Market’s top source for industry news, and the producer and host of LawCast.com, the securities law network. In addition to many other major metropolitan areas, the firm currently represents clients in New York, Las Vegas, Los Angeles, Miami, Boca Raton, West Palm Beach, Atlanta, Phoenix, Scottsdale, Charlotte, Cincinnati, Cleveland, Washington, D.C., Denver, Tampa, Detroit and Dallas.

Contact Legal & Compliance LLC. Technical inquiries are always encouraged.

Follow me on Facebook, LinkedIn, YouTube, Google+, Pinterest and Twitter.

Legal & Compliance, LLC makes this general information available for educational purposes only. The information is general in nature and does not constitute legal advice. Furthermore, the use of this information, and the sending or receipt of this information, does not create or constitute an attorney-client relationship between us. Therefore, your communication with us via this information in any form will not be considered as privileged or confidential.

This information is not intended to be advertising, and Legal & Compliance, LLC does not desire to represent anyone desiring representation based upon viewing this information in a jurisdiction where this information fails to comply with all laws and ethical rules of that jurisdiction. This information may only be reproduced in its entirety (without modification) for the individual reader’s personal and/or educational use and must include this notice.

© Legal & Compliance, LLC 2017

« SEC Issues Whitepaper On Title III Crowdfunding Recommendations Of SEC Government-Business Forum On Small Business Capital Formation »

SEC Issues Whitepaper On Title III Crowdfunding

On February 28, 2017, the SEC released a white paper on Regulation Crowdfunding, which law went into effect on May 16, 2016. Regulation Crowdfunding had been long in the making, with the JOBS Act having been passed on April 5, 2012, and the first set of proposed crowdfunding rules having been published on October 23, 2013. Regulation Crowdfunding provides the rules implementing Section 4(a)(6) of the Securities Act of 1933 (the Securities Act). For a summary of Regulation Crowdfunding, see my blog HERE.

From the time the SEC published the final Regulation Crowdfunding rules and regulations on October 30, 2015, the regulatory framework has met with wide criticism. The most commonly repeated issues with the current structure include: (i) the $1 million annual minimum is too low to adequately meet small-business funding needs; (ii) companies cannot “test the waters” in advance of or at the initial stages of an offering; and (iii) companies cannot currently use a Special Purchase Vehicle (SPV) in a crowdfunding offering.

To address the feedback and offer a resolution, on March 23, 2016, North Carolina Representative Patrick McHenry introduced HR 4855, aptly titled the “Fix Crowdfunding Act.” The Fix Crowdfunding Act would increase the annual funding limit from $1 million to $5 million. The Act would also allow for the use of special purpose vehicles (SPV’s) in the fundraising process. It is thought that an SPV structure helps protect the smaller investors by allowing them to pool funds together with larger investors in an entity that offers separate protections than the offering company itself. Finally, the Fix Crowdfunding Act adds “test the waters” provisions allowing companies to communicate with potential investors and gauge interest before spending significant time and expense on the offering process. The Fix Crowdfunding Act passed the House on July 5, 2016, but there has been no further action.

Background

Crowdfunding generally is where an entity or individual raises funds by seeking small contributions from a large number of people. The crowdfunder sets a goal amount to be raised from the crowd, with the funds to be used for a specific business purpose. In addition, a crowdfunding campaign allows the crowd to communicate with each other, thus adding the benefit of the “wisdom of the crowd.” Small businesses can particularly benefit from crowdfunding as they are not limited by purchaser qualification requirements and, subject to the rules, can engage in general solicitation and advertising. It is intended that crowdfunding offerings will be relatively low-cost and easy to implement; however, the general consensus is that that particular goal falls short.

Title III of the JOBS Act amended Section 4 of the Securities Act, adding Section 4(a)(6) to create a new exemption to the registration requirements of Section 5 of the Securities Act. Effective May 16, 2016, Regulation Crowdfunding, implementing Section 4(a)(6), became effective.

Regulation Crowdfunding allows companies to solicit “crowds” to sell up to $1 million in securities in any 12-month period as long as no individual investment exceeds certain threshold amounts. Regulation Crowdfunding limits investment amounts per investor for all crowdfunding offerings by all issuers in any 12-month period as follows: (a) if either annual income or net worth is less than $100,000, the investment limitation is the greater of $2,000 or 5% of the lesser of annual income or net worth; or (b) if both annual income and net worth are equal to or greater than $100,000, the investment limitation is 10% of the lesser of annual income or net worth. In addition, the final rule provides an overall investment limitation of $100,000 for any investor in any 12-month period. Significantly, the investment limitations apply across all crowdfunding issuers during any 12-month period.

Regulation Crowdfunding requires that all crowdfunding offerings be conducted through an intermediary that is a broker-dealer or funding portal that is registered with the SEC and a member of FINRA. All offerings must be conducted through the intermediary’s Internet-based platform. Securities sold in a crowdfunding offering are generally restricted for one year.

In offerings over $100,000, financial statements must be reviewed by an independent accountant and in offerings over $500,000 audited financial statements must be provided, provided however that audits are not required for a first-time offering.

In addition, Regulation Crowdfunding requires that companies and intermediaries provide certain information to investors, potential investors and the SEC prior to making an investment. The offering disclosure document is on Form C. Companies must also provide the SEC and investors with a closing report on Form C-U and an annual report on Form C-AR following the offering.

The registered intermediary has certain requirements designed to reduce fraud. Among others, the intermediary is responsible for filing the Form C with the SEC, must provide communication channels to allow discussion of the offerings on its platform, must disclose compensation received by the intermediary, and must provide educational materials to investors.

The ability to utilize crowdfunding is subject to bad boy restrictions and other disqualifying events. All crowdfunding issuers must be United States entities. Crowdfunding issuers cannot be subject to the reporting requirements of the Securities Exchange Act of 1934 or an investment company as defined by the Investment Company Act of 1940.

The SEC White Paper

The SEC white paper reviewed crowdfunding offerings from the date of inception of Regulation Crowdfunding on May 16, 2016, through December 31, 2016. During that time there were 163 offerings by 156 companies seeking to raise a total of $18 million. The average offering sought $110,000 but allowed over-subscriptions, generally up to the total $1 million statutory limit. The average offering closed in 4 to 5 months.

Since first-time issuers are not required to file audited financial statements, many set maximum offering limits at the total allowed $1 million mark. As repeat issuers enter the market, the average size of maximum offering amount may decrease to avoid audit expenses.

Of the offerings, approximately $10 million was raised, by 33 issuers, with the average amount raised being $290,000. However, some of these offerings remained open on December 31, 2016, so this number would likely be higher today.

For offerings initiated in 2016, 24 were withdrawn by companies or associated with an intermediary whose FINRA membership was terminated and funding portal registration withdrawn, seeking a total of $2.3 million based on the target amount.

Most offerings solicited in all states. The most popular type of securities was equity, including both common and preferred, followed by simple agreements for future equity (SAFE’s) and debt.

The most popular state of incorporation was Delaware, and the most popular location of the business was California, followed by Texas and New York. Most issuers have been pre-revenue start-ups or development-stage companies, with the median company having under $50,000 in assets, under $5,000 in cash, $10,000 in debt, no revenues and 3 employees. The average issuer had 5 employees, assets of $327,000 and cash of $64,000. However, many companies were growing. The median growth from the prior fiscal year was 15%, and median sales growth was 80%.

Some of the companies also did prior, concurrent or subsequent Regulation D (15%) or Regulation A (3%) offerings. None of the issuers had previously been listed on an exchange or subject to the Exchange Act reporting requirements.

As of December 31, 2016, 21 funding portals have registered with the SEC and FINRA. One funding portal had its FINRA membership terminated and withdrew its SEC registration. In addition, 8 broker-dealers have conducted crowdfunding offerings. The average funding portal fee is 5%, though broker-dealers averaged at 7.7%.

The SEC acknowledges that the initial results are probably not indicative of what the crowdfunding market will look like as it matures. In particular, companies, investors and the intermediaries will gain experience and learn from mistakes as time goes on. Moreover, it is likely that the number of intermediaries will grow and some may be industry-specific or concentrate on specific demographics.

Click Here To Print- PDF Printout SEC Issues Whitepaper On Title III Crowdfunding

The Author

Laura Anthony, Esq.

Founding Partner

Legal & Compliance, LLC

Corporate, Securities and Going Public Attorneys

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

Phone: 800-341-2684 – 561-514-0936

Fax: 561-514-0832

LAnthony@LegalAndCompliance.com

www.LegalAndCompliance.com

www.LawCast.com

Securities attorney Laura Anthony and her experienced legal team provides ongoing corporate counsel to small and mid-size private companies, OTC and exchange traded issuers as well as private companies going public on the NASDAQ, NYSE MKT or over-the-counter market, such as the OTCQB and OTCQX. For nearly two decades Legal & Compliance, LLC has served clients providing fast, personalized, cutting-edge legal service. The firm’s reputation and relationships provide invaluable resources to clients including introductions to investment bankers, broker dealers, institutional investors and other strategic alliances. The firm’s focus includes, but is not limited to, compliance with the Securities Act of 1933 offer sale and registration requirements, including private placement transactions under Regulation D and Regulation S and PIPE Transactions as well as registration statements on Forms S-1, S-8 and S-4; compliance with the reporting requirements of the Securities Exchange Act of 1934, including registration on Form 10, reporting on Forms 10-Q, 10-K and 8-K, and 14C Information and 14A Proxy Statements; Regulation A/A+ offerings; all forms of going public transactions; mergers and acquisitions including both reverse mergers and forward mergers, ; applications to and compliance with the corporate governance requirements of securities exchanges including NASDAQ and NYSE MKT; crowdfunding; corporate; and general contract and business transactions. Moreover, Ms. Anthony and her firm represents both target and acquiring companies in reverse mergers and forward mergers, including the preparation of transaction documents such as merger agreements, share exchange agreements, stock purchase agreements, asset purchase agreements and reorganization agreements. Ms. Anthony’s legal team prepares the necessary documentation and assists in completing the requirements of federal and state securities laws and SROs such as FINRA and DTC for 15c2-11 applications, corporate name changes, reverse and forward splits and changes of domicile. Ms. Anthony is also the author of SecuritiesLawBlog.com, the OTC Market’s top source for industry news, and the producer and host of LawCast.com, the securities law network. In addition to many other major metropolitan areas, the firm currently represents clients in New York, Las Vegas, Los Angeles, Miami, Boca Raton, West Palm Beach, Atlanta, Phoenix, Scottsdale, Charlotte, Cincinnati, Cleveland, Washington, D.C., Denver, Tampa, Detroit and Dallas.

Contact Legal & Compliance LLC. Technical inquiries are always encouraged.

Follow me on Facebook, LinkedIn, YouTube, Google+, Pinterest and Twitter.

Legal & Compliance, LLC makes this general information available for educational purposes only. The information is general in nature and does not constitute legal advice. Furthermore, the use of this information, and the sending or receipt of this information, does not create or constitute an attorney-client relationship between us. Therefore, your communication with us via this information in any form will not be considered as privileged or confidential.

This information is not intended to be advertising, and Legal & Compliance, LLC does not desire to represent anyone desiring representation based upon viewing this information in a jurisdiction where this information fails to comply with all laws and ethical rules of that jurisdiction. This information may only be reproduced in its entirety (without modification) for the individual reader’s personal and/or educational use and must include this notice.

© Legal & Compliance, LLC 2017

« The Senate Banking Committee Passes Several Pro-Business Bills Road Shows »

The Senate Banking Committee Passes Several Pro-Business Bills

On March 9, 2017, the Senate Banking Committee approved the first set of bills to go through the committee under the new administration. The five bills were cleared as one package and are aimed at making it easier for companies to grow and raise capital. The bills are bipartisan and could be some of the first to pass through Congress under the new regime. Only two Democrats opposed the bills: Massachusetts Senator Elizabeth Warren, who is consistently pushing for greater investor protections regardless of the impact on businesses, and Rhode Island Senator Jack Reed.

Interestingly, in 2016, most of these pro-business bills were passed by the House and never made it through the Senate. For a brief outline of the numerous House bills passed in 2016, see my blog HERE. Each of the current bills had already been presented in prior years, either as stand-alone bills or packaged with other provisions, but never made it through the Senate. The following is a summary of the new bills.

Fair Access to Investment Research Act of 2017 (S.327)

The Fair Access to Investment Research Act would require the SEC to expand a safe harbor for certain investment fund research reports. The bill would amend Rule 139 covering the publications or distributions of research reports on investment funds by brokers or dealers distributing securities. In particular, the bill clarifies that a covered investment fund research report that is published or distributed by a broker-dealer would not be deemed an offer for sale or offer to sell a security under Sections 2(a)(10) or 5(c) of the Securities Act of 1933, even if such broker-dealer was participating in a registered offering of that fund’s securities. The bill would require FINRA to make conforming changes as well.

Section 2(a)(10) of the Securities Act defines the term “prospectus” and Section 5(c) prohibits the offer or sale of securities unless a registration statement has been filed (or there is a valid exemption from registration). The Fair Access to Investment Research Act would remove investment fund research reports from the definition of an offer for sale or offer to sell and related prospectus delivery requirements.

The House passed a substantially similar provision as part of the Financial Choice Act—to wit: the H.R. 5019 – Fair Access to Investment Research Act (expanding exclusion of research reports from the definition of an offer for or to sell securities under the Securities Act).

Previously, Title I of the JOBS Act amended Section 2(a)(3) of the Securities Act to eliminate restrictions on publishing analyst research and communications while IPO’s for Emerging Growth Companies (EGC’s) are under way. Section 2(a)(3) defines the terms sale or sell and related offers. Under prior law, research reports by analysts, especially those participating in an underwriting of securities of the subject issuer, could be deemed to be “offers” of those securities under the Securities Act and, as a result, could not be issued prior to completion of an offering. Section 2(a)(3) of the Securities Act as amended by Section 105(a) of the JOBS Act provides that publication or distribution by a broker or dealer of a research report about an EGC that is the subject of a proposed public offering of its securities does not constitute an offer of securities, even if the broker or dealer that publishes the research is participating or will participate as an underwriter in the offering. Moreover, the term “research” is defined broadly as any information, opinion or recommendation about a company and includes oral as well as written and electronic communications.This research need not be accompanied by a full prospectus and need not provide information “reasonably sufficient upon which to base an investment decision.”

Section 105(b) of the JOBS Act also eliminated restrictions on publishing research following an IPO or around the time the IPO lockup period expires or is released. Prior to that time, under SEC and Financial Industry Regulatory Authority (“FINRA”) rules, underwriters of an IPO could not publish research for 25 days after the offering (40 days if they served as a manager or co-manager), and managers or co-managers cannot publish research within 15 days prior to or after the release or expiration of the IPO lockup agreements (so-called “booster shot” reports). The JOBS Act eliminated those provisions related to an EGC. On October 11, 2012, FINRA amended its rules to conform to the requirements.

The new rules would expand the safe-harbor provisions to include research related to covered investment funds.

Supporting America’s Innovators Act of 2017 (S. 444)

This bill expands a registration exemption under the Investment Company Act of 1940 for venture capital funds with less than $10,000,000 in capital contributions.

A very similar bill was passed by the House on December 5, 2016, i.e. the Supporting America’s Innovators Act (H.R. 4854). The House bill would create a new small “qualifying venture capital fund” under the Investment Company Act of 1940 and increase the current registration exemption under Section 3(c)(1) of the Investment Company Act to allow for up to 250 investors in such qualifying venture capital fund. Currently Section 3(c)(1) of the Investment Company Act exempts pooled funds, such as hedge funds, from registering under the Act as long as they have fewer than 100 equity holders. Currently, there is no limit on the amount of invested capital in a fund to qualify for the 3(c)(1) exemption. H.R. 4854 would create a new class of pooled fund, called a “qualifying venture capital fund,” which would be defined as any venture fund with $10 million or less of invested capital and allow up to 250 investors in such fund.

The Senate bill only includes the $10,000,000 threshold and does not refer to the number of investors in a qualifying venture capital fund.

Securities and Exchange Commission Overpayment Credit Act (S. 462)

This bill requires the SEC to give a credit to any national securities exchange or national securities association for any fees or assessments paid to the SEC within the last ten (10) years that were more than the amount such exchange or association was required to pay. The bill is strictly retroactive, providing credits for past overpayments, and does not apply to pre-bill payments.

U.S. Territories Investor Protection Act of 2017 (S. 484)

This bill amends the Investment Company Act of 1940 to terminate an exemption for companies located in Puerto Rico, the Virgin Islands or any other possession of the United States. The Investment Company Act currently exempts companies organized and having their principal place of business in Puerto Rico, the Virgin Islands or any other possession of the U.S. as long as such companies do not sell securities to any resident outside of such territory. The Act provides a 3-year safe harbor for compliance with the ability for the SEC to add an additional 3 years by passing a rule extending the time for compliance.

Encouraging Employee Ownership Act (S. 488)

This bill would raise the threshold for disclosure obligations under Rule 701 under the Securities Act from $5,000,000 to $10,000,000. In particular, under the current Rule 701, a company must provide enhanced and specifically delineated disclosures to employees where such company sells in excess of $5,000,000 to employees under a written incentive or stock option plan, in any 12-month period. A substantially similar bill passed the House in 2016 (H.R. 1675). The bill would amend the rule to increase that threshold to $10,000,000. For more information on Rule 701, see my blog HERE.

Click Here To Print- PDF Printout The Senate Banking Committee Passes Several Pro-Business Bills

The Author

Laura Anthony, Esq.

Founding Partner

Legal & Compliance, LLC

Corporate, Securities and Going Public Attorneys

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

Phone: 800-341-2684 – 561-514-0936

Fax: 561-514-0832

LAnthony@LegalAndCompliance.com

www.LegalAndCompliance.com

www.LawCast.com

Securities attorney Laura Anthony and her experienced legal team provides ongoing corporate counsel to small and mid-size private companies, OTC and exchange traded issuers as well as private companies going public on the NASDAQ, NYSE MKT or over-the-counter market, such as the OTCQB and OTCQX. For nearly two decades Legal & Compliance, LLC has served clients providing fast, personalized, cutting-edge legal service. The firm’s reputation and relationships provide invaluable resources to clients including introductions to investment bankers, broker dealers, institutional investors and other strategic alliances. The firm’s focus includes, but is not limited to, compliance with the Securities Act of 1933 offer sale and registration requirements, including private placement transactions under Regulation D and Regulation S and PIPE Transactions as well as registration statements on Forms S-1, S-8 and S-4; compliance with the reporting requirements of the Securities Exchange Act of 1934, including registration on Form 10, reporting on Forms 10-Q, 10-K and 8-K, and 14C Information and 14A Proxy Statements; Regulation A/A+ offerings; all forms of going public transactions; mergers and acquisitions including both reverse mergers and forward mergers, ; applications to and compliance with the corporate governance requirements of securities exchanges including NASDAQ and NYSE MKT; crowdfunding; corporate; and general contract and business transactions. Moreover, Ms. Anthony and her firm represents both target and acquiring companies in reverse mergers and forward mergers, including the preparation of transaction documents such as merger agreements, share exchange agreements, stock purchase agreements, asset purchase agreements and reorganization agreements. Ms. Anthony’s legal team prepares the necessary documentation and assists in completing the requirements of federal and state securities laws and SROs such as FINRA and DTC for 15c2-11 applications, corporate name changes, reverse and forward splits and changes of domicile. Ms. Anthony is also the author of SecuritiesLawBlog.com, the OTC Market’s top source for industry news, and the producer and host of LawCast.com, the securities law network. In addition to many other major metropolitan areas, the firm currently represents clients in New York, Las Vegas, Los Angeles, Miami, Boca Raton, West Palm Beach, Atlanta, Phoenix, Scottsdale, Charlotte, Cincinnati, Cleveland, Washington, D.C., Denver, Tampa, Detroit and Dallas.

Contact Legal & Compliance LLC. Technical inquiries are always encouraged.

Follow me on Facebook, LinkedIn, YouTube, Google+, Pinterest and Twitter.

Legal & Compliance, LLC makes this general information available for educational purposes only. The information is general in nature and does not constitute legal advice. Furthermore, the use of this information, and the sending or receipt of this information, does not create or constitute an attorney-client relationship between us. Therefore, your communication with us via this information in any form will not be considered as privileged or confidential.

This information is not intended to be advertising, and Legal & Compliance, LLC does not desire to represent anyone desiring representation based upon viewing this information in a jurisdiction where this information fails to comply with all laws and ethical rules of that jurisdiction. This information may only be reproduced in its entirety (without modification) for the individual reader’s personal and/or educational use and must include this notice.

© Legal & Compliance, LLC 2017

« SEC Completes Inflation Adjustment Under Titles I And III Of The Jobs Act; Adopts Technical Amendments SEC Issues Whitepaper On Title III Crowdfunding »

SEC Completes Inflation Adjustment Under Titles I And III Of The Jobs Act; Adopts Technical Amendments

On March 31, 2017, the SEC adopted several technical amendments to rules and forms under both the Securities Act of 1933 (“Securities Act”) and Securities Exchange Act of 1934 (“Exchange Act”) to conform with Title I of the JOBS Act. On the same day, the SEC made inflationary adjustments to provisions under Title I and Title III of the JOBS Act by amending the definition of the term “emerging growth company” and the dollar amounts in Regulation Crowdfunding.

Title I of the JOBS Act, initially enacted on April 5, 2012, created a new category of issuer called an “emerging growth company” (“EGC”). The primary benefits to an EGC include scaled-down disclosure requirements both in an IPO and periodic reporting, confidential filings of registration statements, certain test-the-waters rights in IPO’s, and an ease on analyst communications and reports during the EGC IPO process. For a summary of the scaled disclosure available to an EGC as well as the differences in disclosure requirements between an EGC and a smaller reporting company, see HERE.

As a reminder, the definition of an EGC as enacted on April 5, 2012 (i.e., not including the new inflationary adjustment discussed in this blog) is a company with total annual gross revenues of less than $1 billion during its most recently completed fiscal year that first sells equity in a registered offering after December 8, 2011. An EGC loses its EGC status on the earlier of (i) the last day of the fiscal year in which it exceeds $1 billion in revenues; (ii) the last day of the fiscal year following the fifth year after its IPO (for example, if the issuer has a December 31 fiscal year-end and sells equity securities pursuant to an effective registration statement on May 2, 2016, it will cease to be an EGC on December 31, 2021); (iii) the date on which it has issued more than $1 billion in non-convertible debt during the prior three-year period; or (iv) the date it becomes a large accelerated filer (i.e., its non-affiliated public float is valued at $700 million or more). EGC status is not available to asset-backed securities issuers (“ABS”) reporting under Regulation AB or investment companies registered under the Investment Company Act of 1940, as amended. However, business development companies (BDC’s) do qualify.

The provisions of Title I of the JOBS Act were self-executing and automatically became effective on April 5, 2012. Although the SEC has passed several rules and made numerous form amendments to conform to the JOBS Act provisions, several of the rules and forms under the Securities Act, Exchange Act, periodic and current reports forms, Regulation S-K and Regulation S-X did not reflect the JOBS Act provisions.

The statutory definition of an EGC, as reflected in Securities Act Section 2(a)(10) and Exchange Act Section 3(a)(80), require the SEC to make an adjustment to index to inflation the annual gross revenue amount used to determine an EGC, every five years.

Likewise, Title III of the JOBS Act, which set the statutory groundwork for Regulation Crowdfunding, requires an inflationary adjustment to the dollar figures in Regulation Crowdfunding every five years. On March 31, 2017, the SEC did so for the first time.

Inflation Adjustments

Definition of “Emerging Growth Company”

The JOBS Act amended Section 2(a)(19) of the Securities Act and Section 3(a)(80) of the Exchange Act to define an “emerging growth company” to mean a company with total annual gross revenues of less than $1 billion, as adjusted for inflation every 5 years, during its most recently completed fiscal year that first sells equity in a registered offering after December 8, 2011.

The SEC is now making its first inflationary increase to the definition. The inflation increase is $70,000. Accordingly, an EGC is now defined as a company with total gross revenues of less than $1,070,000,000.

Regulation Crowdfunding Amendments

Title III of the JOBS Act, enacted in April 2012, amended the Securities Act to add Section 4(a)(6) to provide an exemption for crowdfunding offerings. Regulation Crowdfunding went into effect on May 16, 2016. For a summary of the provisions, see HERE. The Securities Act requires that the amounts set forth in Regulation Crowdfunding be adjusted by the SEC for inflation not less than once every five years. The SEC is now making its first inflationary increase by amending Rules 100 and 201(t) of Regulation Crowdfunding and Securities Act Form C. The inflation increase is $70,000.

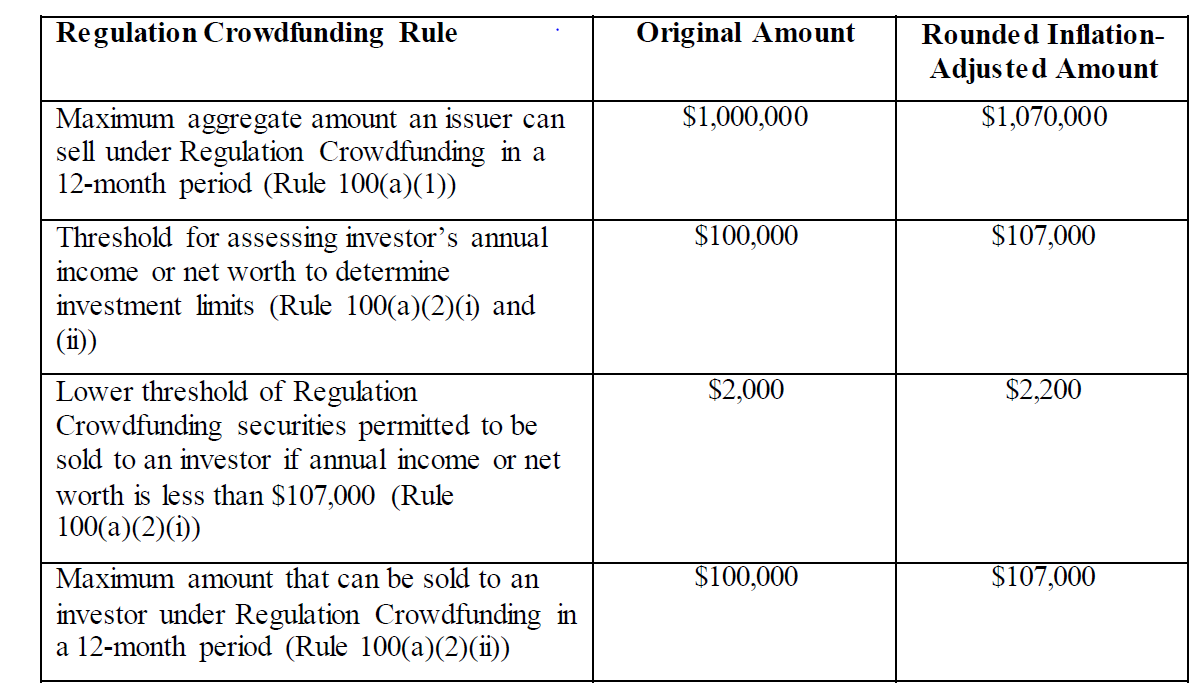

The new offering amount and investment limits are as follows:

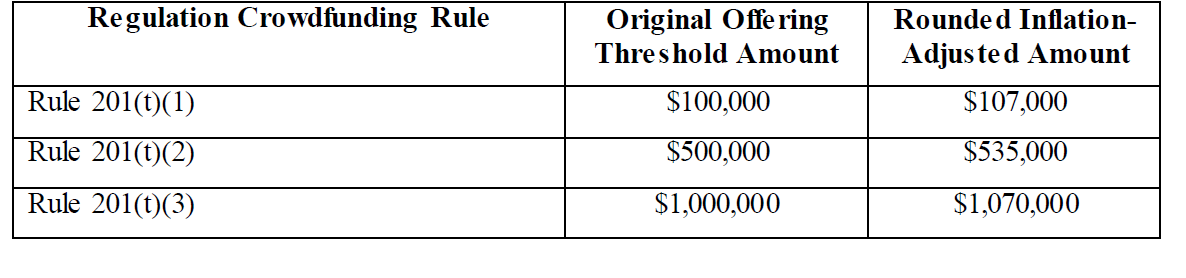

The new financial statement requirement thresholds are as follows:

Technical Amendments to Rules and Forms

Technical Amendments to Rules and Forms

Scaled Disclosure in Registration Forms and Periodic Reports

Section 102(b)(1) of the JOBS Act amended Section 7(a) of the Securities Act to provide that (1) an EGC is permitted to present only two years of audited financial statements in its IPO registration statement, and (2) in any Securities Act registration statement other than its IPO registration statement, an EGC need not present selected financial data under Item 301 of Regulation S-K for any period prior to the earliest audited period presented in its IPO registration statement. However, Item 301 and Rule 3-02 of Regulation S-X and Form 20-F had not been amended for these changes and, until now, contained conflicting requirements. In particular, such rules and forms only addressed reduced disclosure requirements for smaller reporting companies and not address the JOBS Act rules related to EGC’s. The SEC is now amending Item 301 and Rule 3-02 of Regulation S-X and Form 20-F to conform with Section 7(a) of the Securities Act.

Section 102(b)(2) of the JOBS Act amended Section 13(a) of the Exchange Act to provide that an EGC need not present selected financial data in an Exchange Act registration statement or periodic report for any period prior to the earliest audited period presented in the EGC’s first effective registration statement under either the Exchange Act or Securities Act. The SEC is now amending Item 301 of Regulation S-X to conform with Section 13(a) of the Exchange Act.

Likewise, the SEC is amending Item 303 of Regulation S-K related to management discussion and analyses (MD&A) such that a disclosure needs only to be provided for the periods of the financial statements included in the EGC’s IPO registration statement.

Auditor Attestation; Section 404(b) of Sarbanes-Oxley

Section 103 amended Section 404(b) of the Sarbanes-Oxley Act to exempt EGC’s from the need to provide an auditor attestation on management’s assessment of the effectiveness of the EGC’s internal controls over financial reporting. Compliance with Section 404(b) is very expensive, with the average cost being in the $2 million range. To conform with SEC rules and forms to amended Section 404(b), the SEC has amended Article 2-02 of Regulation S-X, Item 308 of Regulation S-K, and Forms 20-F and 40-F to specify that the auditor of an EGC does not need to attest to, and report on, management’s report on internal control over financial reporting and that management does not need to include the auditor’s attestation report in an annual report required by Section 13(a) or 15(d) of the Exchange Act.

Executive Compensation Disclosure and Shareholder Advisory Vote

Section 102(c) of the JOBS Act provides that an EGC need only provide the same executive compensation disclosure as a smaller reporting company. The smaller reporting company executive compensation disclosures are delineated in Items 402(m)-(r) of Regulation S-K. The SEC is amending Item 402 to specify that these scaled disclosures also apply to EGC’s.

Exchange Act Rule 14a-21 requires companies to conduct shareholder advisory votes on say-on-pay, say-on-frequency and golden parachute compensation arrangements with any “named executive officers.” Item 102(a) of the JOBS Act amended Section 14A(e) of the Exchange Act to exempt EGC’s from these requirements. The SEC is amending Exchange Act Rule 14a-21 and Item 402(t) and Instruction 1 to Item 1011(b) of Regulation S-K to conform with this statutory exemption. For more on say-on-pay, say-on-frequency and golden parachute compensation disclosures, see HERE.

Foreign Private Issuers

The definition of an emerging growth company is not dependent on whether the company is domestic or qualifies as a foreign private issuer. A foreign private issuer that qualifies as an EGC may avail itself of the scaled disclosures to the same extent as domestic companies. The SEC is now amending Form 20-F to conform its disclosure requirements with those available to an EGC.

“Check Box” Notice of EGC Status and Compliance with New or Revised Accounting Standards

Section 102(b) of the JOBS Act amended Section 7(a)(2)(B) of the Securities Act and Section 13(a) of the Exchange Act such that an EGC is not required to comply with new or revised financial accounting standards until private companies are also required to comply with those standards. An EGC can, however, choose to comply with such new or revised accounting standards but must do so on the next report or registration statement and notify the SEC of its choice. The election is irrevocable. To provide a method to inform the SEC of its choice, the SEC is adding a “check box” to Securities Act Forms S-1, S-3, S-4, S-8, S-11, F-1, F-3 and F-4 and Exchange Act Forms 10, 8-K, 10-Q, 10–K, 20–F and 40-F.

Click Here To Print- PDF Printout SEC Completes Inflation Adjustment Under Titles I And III Of The Jobs Act; Adopts Technical Amendments

The Author

Laura Anthony, Esq.

Founding Partner

Legal & Compliance, LLC

Corporate, Securities and Going Public Attorneys

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

Phone: 800-341-2684 – 561-514-0936

Fax: 561-514-0832

LAnthony@LegalAndCompliance.com

www.LegalAndCompliance.com

www.LawCast.com

Securities attorney Laura Anthony and her experienced legal team provides ongoing corporate counsel to small and mid-size private companies, OTC and exchange traded issuers as well as private companies going public on the NASDAQ, NYSE MKT or over-the-counter market, such as the OTCQB and OTCQX. For nearly two decades Legal & Compliance, LLC has served clients providing fast, personalized, cutting-edge legal service. The firm’s reputation and relationships provide invaluable resources to clients including introductions to investment bankers, broker dealers, institutional investors and other strategic alliances. The firm’s focus includes, but is not limited to, compliance with the Securities Act of 1933 offer sale and registration requirements, including private placement transactions under Regulation D and Regulation S and PIPE Transactions as well as registration statements on Forms S-1, S-8 and S-4; compliance with the reporting requirements of the Securities Exchange Act of 1934, including registration on Form 10, reporting on Forms 10-Q, 10-K and 8-K, and 14C Information and 14A Proxy Statements; Regulation A/A+ offerings; all forms of going public transactions; mergers and acquisitions including both reverse mergers and forward mergers, ; applications to and compliance with the corporate governance requirements of securities exchanges including NASDAQ and NYSE MKT; crowdfunding; corporate; and general contract and business transactions. Moreover, Ms. Anthony and her firm represents both target and acquiring companies in reverse mergers and forward mergers, including the preparation of transaction documents such as merger agreements, share exchange agreements, stock purchase agreements, asset purchase agreements and reorganization agreements. Ms. Anthony’s legal team prepares the necessary documentation and assists in completing the requirements of federal and state securities laws and SROs such as FINRA and DTC for 15c2-11 applications, corporate name changes, reverse and forward splits and changes of domicile. Ms. Anthony is also the author of SecuritiesLawBlog.com, the OTC Market’s top source for industry news, and the producer and host of LawCast.com, the securities law network. In addition to many other major metropolitan areas, the firm currently represents clients in New York, Las Vegas, Los Angeles, Miami, Boca Raton, West Palm Beach, Atlanta, Phoenix, Scottsdale, Charlotte, Cincinnati, Cleveland, Washington, D.C., Denver, Tampa, Detroit and Dallas.

Contact Legal & Compliance LLC. Technical inquiries are always encouraged.

Follow me on Facebook, LinkedIn, YouTube, Google+, Pinterest and Twitter.

Legal & Compliance, LLC makes this general information available for educational purposes only. The information is general in nature and does not constitute legal advice. Furthermore, the use of this information, and the sending or receipt of this information, does not create or constitute an attorney-client relationship between us. Therefore, your communication with us via this information in any form will not be considered as privileged or confidential.

This information is not intended to be advertising, and Legal & Compliance, LLC does not desire to represent anyone desiring representation based upon viewing this information in a jurisdiction where this information fails to comply with all laws and ethical rules of that jurisdiction. This information may only be reproduced in its entirety (without modification) for the individual reader’s personal and/or educational use and must include this notice.

© Legal & Compliance, LLC 2017

« SEC Adopts The T+2 Trade Settlement Cycle The Senate Banking Committee Passes Several Pro-Business Bills »

SEC Adopts The T+2 Trade Settlement Cycle

Introduction and brief summary of the rule

On March 22, 2017, the SEC adopted a rule amendment shortening the standard settlement cycle for broker-initiated trade settlements from three business days from the trade date (T+3) to two business days (T+2). The change is designed to help enhance efficiency and reduce risks, including credit, market and liquidity risks, associated with unsettled transactions in the marketplace.

Acting SEC Chair Michael Piwowar stated, “[A]s technology improves, new products emerge, and trading volumes grow, it is increasingly obvious that the outdated T+3 settlement cycle is no longer serving the best interests of the American people.” The SEC originally proposed the rule amendment on September 28, 2016. My blog on the proposal can be read HERE. In addition, for more information on the clearance and settlement process for U.S. capital markets, see HERE.

The change amends Rule 15c6-1(a) prohibiting a broker-dealer from effecting or entering into a contract for the purchase or sale of a security that provides for payment of funds and delivery of securities later than T+2, unless otherwise expressly agreed to by the parties at the time of the transaction. This means that when an investor buys a security, the brokerage firm must receive payment from the investor no later than two business days after the trade is executed. Also, when an investor sells a security, the investor must deliver the investor’s security to the brokerage firm no later than two business days after the sale.

The rule does not apply to private exempt transactions such as private placements. The rule also allows a managing underwriter and issuer to agree to a trade settlement cycle other than T+2 as long as the agreement is express and reached at the time of the transaction. Firm commitment offerings are also exempted. In particular, Rule 15c6-1(c) allows registered firm commitment underwritten transactions that price after 4:30 p.m. ET to use a T+3 or T+4 settlement cycle.

The reduction of the settlement cycle to T+2 will also assist in aligning global clearing of securities as many markets, including the United Kingdom and many European countries, are already on the T+2 schedule.

Compliance with the new rules is effective on September 5, 2017.

Background

DTC provides the depository and book entry settlement services for substantially all equity trading in the US. Over $600 billion in transactions are completed at DTC each day. Although all similar, the exact clearance and settlement process depends on the type of security being traded (stock, bond, etc.), the form the security takes (paper or electronic), how the security is owned (registered or beneficial), the market or exchange traded on (OTC Markets, NASDAQ…) and the entities and institutions involved.